Introduction

Exploring Islamic home financing is an exciting step, but it can also feel overwhelming — especially if you’re comparing it to conventional mortgage options. The good news? Asking the right questions can help you gain confidence and clarity while making sure your financing aligns with both your faith and your financial goals.

Here are the top five questions every homebuyer should ask before choosing Islamic home financing.

1. What Makes Halal Home Financing Different From a Conventional Mortgage?

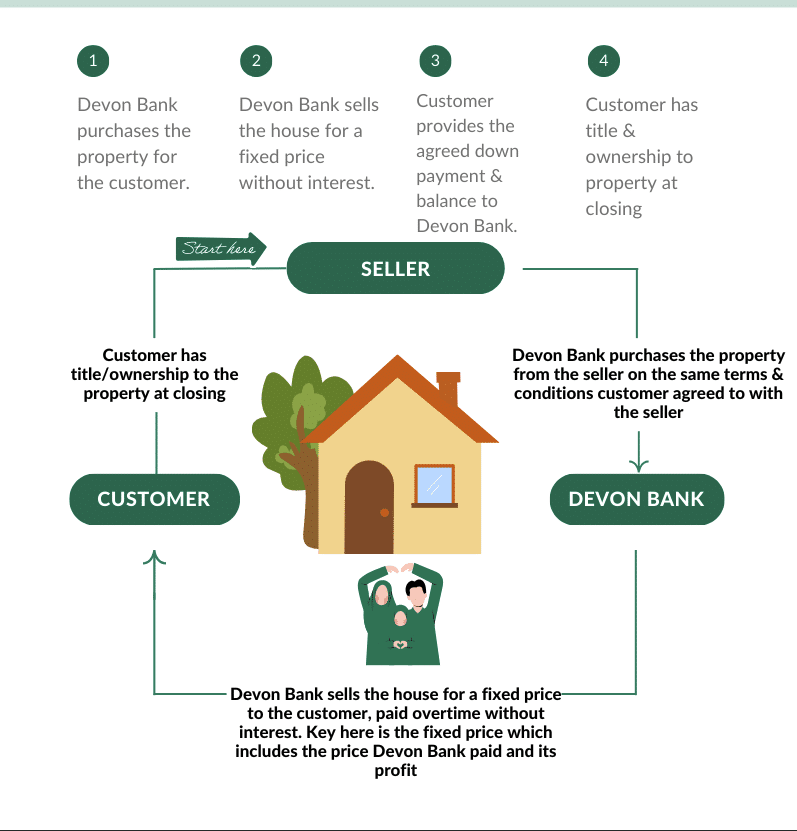

The heart of Islamic finance lies in the prohibition of riba (interest). Instead of lending money and charging interest, halal products like Murabaha are based on real transactions:

- Devon Islamic purchases the property.

- The property is resold to you at a disclosed, fixed profit.

- Payments are made over time, with no interest involved.

Asking this question ensures you understand the ethical foundation behind your financing choice.

2. What Is the Profit Rate, and How Is It Determined?

Profit rate is often compared to interest in the conventional world, but the two are very different.

- Profit rate = the markup agreed upon in your halal contract.

- It reflects costs, benchmarks like SOFR, and operational sustainability — not interest on borrowed money.

This question helps you understand pricing transparency and how your total cost is structured.

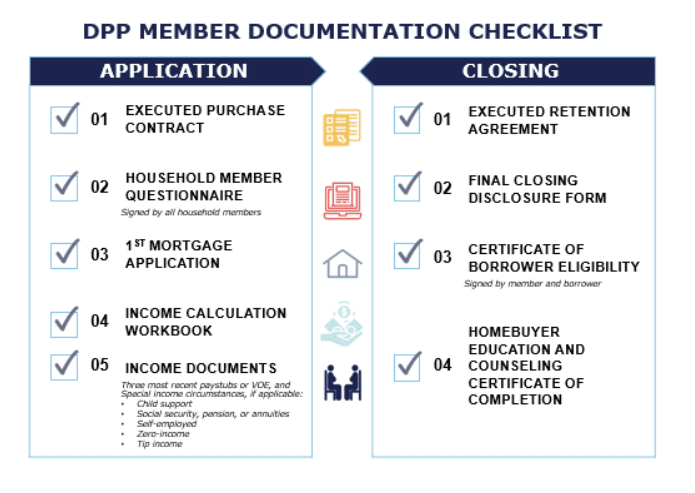

3. What Are the Eligibility Requirements?

Before you get too deep into the process, it’s wise to know the basics:

- Minimum credit score: 620

- Maximum DTI: 45%

- Down payment: As low as 5%, depending on product and qualification.

By asking about eligibility early, you avoid surprises and can prepare accordingly.

4. Are There Programs to Help With Affordability?

Halal homeownership doesn’t have to feel out of reach. Ask about:

- Down Payment Assistance (DPA): Options may cover a portion of your down payment or closing costs.

- Debt Diminisher (D3™) Card: A unique Devon Islamic feature that rounds up everyday purchases and applies the difference toward your Murabaha balance.

These programs can make halal homeownership more accessible and help you pay off faster.

5. What Is the Pre-Qualification Process Like?

Unlike conventional “pre-approvals,” Devon Islamic offers pre-qualification as a first step.

- It’s quick, no-obligation, and helps you understand your price range.

- It also signals to real estate agents that you’re a serious, prepared buyer.

By asking this question, you’ll know what to expect before you begin shopping for your home.

Conclusion

Choosing halal financing is about more than numbers — it’s about aligning your faith with one of life’s biggest milestones. By asking these five questions, you’ll be equipped with the knowledge and confidence to take the next step toward halal homeownership.