Is Islamic Home Financing Truly Different? Let’s Set the Record Straight!

For many prospective homeowners, the concept of Islamic home financing raises a lot of questions. Is it really different from conventional mortgages? How does it work without interest? Is it just a renamed version of a traditional loan?

At Devon Islamic, we understand these concerns and are committed to educating and empowering our communities with ethical, faith-based financial solutions. In this blog, we’ll debunk common myths and provide clarity on how Shariah-compliant home financing works.

What is Islamic Home Financing?

Islamic home financing is an interest-free alternative to conventional mortgages that complies with Shariah (Islamic law). Instead of charging riba (interest), Islamic banks and financial institutions use profit-sharing, leasing, or partnership-based structures to facilitate homeownership.

The goal? To ensure financing remains fair, transparent, and aligned with ethical principles—free from exploitative interest rates or excessive financial burdens.

Common Myths About Islamic Home Financing – Debunked!

Myth #1: “Islamic home financing is just a renamed mortgage.”

✅ Reality: Unlike conventional loans, Islamic home financing does not charge interest. Instead, it uses Shariah-approved contracts such as:

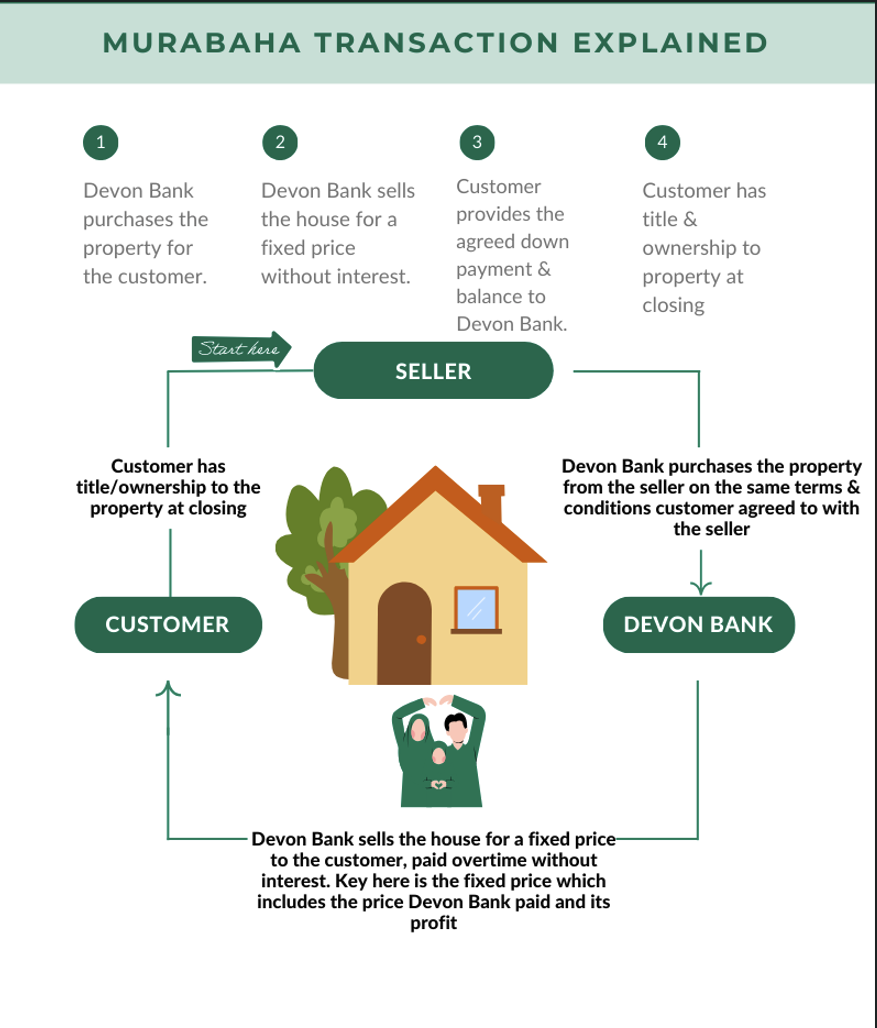

- Murabaha (Cost-Plus Sale): The bank purchases the home and sells it to the buyer at a markup, with a fixed repayment plan.

- Ijarah (Lease-to-Own): The bank retains ownership while the buyer makes monthly payments (rent + principal) until full ownership is transferred.

- Musharakah (Partnership-Based Ownership): The buyer and the bank co-own the property, with the buyer gradually increasing their share over time.

Myth #2: “Islamic financing is more expensive than a traditional mortgage.”

✅ Reality: While some Islamic financing models may have slightly different cost structures, they are designed to be transparent and fair—with no compounding interest or hidden fees. Unlike conventional mortgages, where interest can fluctuate over time, Islamic financing ensures predictable, fixed pricing, giving homeowners peace of mind.

Myth #3: “There’s no difference between paying interest and paying a markup.”

✅ Reality: The difference lies in intent and structure. Interest (riba) is prohibited in Islam because it benefits lenders without sharing any risk. In contrast, Islamic financing operates on a risk-sharing basis, where financial institutions invest in the asset rather than profiting solely from lending money.

In a Murabaha transaction, for example, the markup is disclosed upfront, ensuring full transparency—unlike traditional mortgages where interest accrues over time.

Why Choose Islamic Home Financing?

📌 Ethical & Fair: No interest, excessive fees, or hidden charges.

📌 Shariah-Compliant: Fully aligned with Islamic financial principles.

📌 Transparent Pricing: Fixed repayment plans with no surprises.

📌 Faith-Based Homeownership: Peace of mind knowing your financing aligns with your values.

At Devon Islamic, we are committed to helping families achieve homeownership the halal way. With decades of expertise and a deep understanding of Shariah-compliant financing, we provide trusted, ethical alternatives to traditional mortgages.

Final Thoughts: Making the Right Choice for Your Future

Islamic home financing is not just a name change—it’s a fundamentally different, ethical, and faith-aligned way to buy a home. Whether you’re a first-time homebuyer or looking for a refinancing option that aligns with your beliefs, Devon Islamic is here to guide you every step of the way.

💡 Have more questions? Contact us today and let’s discuss how we can help you achieve riba-free homeownership!

📞 Call us at 888-90-DEVON

📧 Email us at co********@*******nk.com

🌐 Visit our website: devonislamic.com

NMLS #412368, EQUAL HOUSING LENDER.