In today’s ever-evolving economy, market rate changes are a hot topic. Whether you’re new to the home financing journey or exploring Shariah-compliant alternatives, it’s important to understand how economic shifts may impact profit rates—a core element in Islamic home financing.

If you’re wondering what profit rates are, how they’re set, and what to keep an eye on in a changing market, this article breaks it all down in simple terms.

💡 What Is a Profit Rate in Islamic Financing?

In Islamic home financing, profit rates serve a similar role to what interest rates do in conventional mortgages—but the approach is fundamentally different.

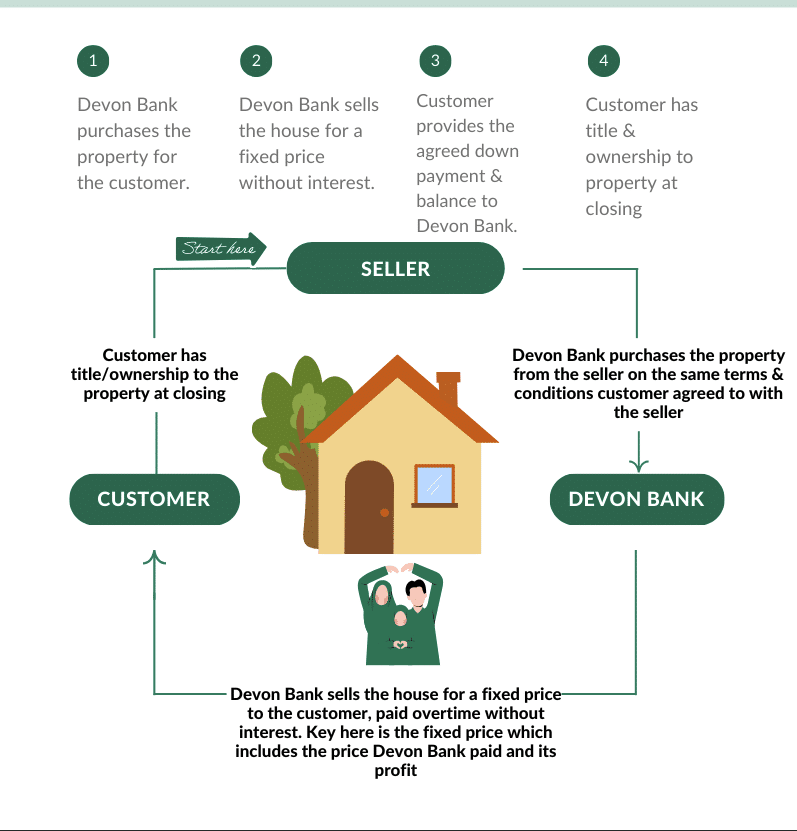

Rather than lending money and charging interest (which is not permitted in Islamic finance), Islamic financial institutions structure contracts like Murabaha (cost-plus sale) or Ijara (lease-to-own), where the institution purchases the home and resells or leases it to the buyer at an agreed-upon profit. That profit rate is either fixed or adjustable depending on the agreement.

➡️ Simply put: It’s the amount the institution earns for facilitating your home purchase—without using interest.

🔄 How Market Conditions Affect Profit Rates

While Islamic financing follows its own contract models, profit rates are still influenced by external economic conditions, such as:

1. Market Benchmarks

Islamic financial institutions often refer to market benchmarks (like SOFR or other commonly used indicators) to stay aligned with prevailing financial conditions. These benchmarks do not define the structure of the contract, but help inform pricing that’s consistent and sustainable.

2. Economic Factors

When inflation rises or the central bank adjusts monetary policy, the cost of funds can increase across the board. This influences the profit rate on new financing contracts, much like how conventional lenders adjust interest rates.

3. Operational Sustainability

Like all institutions, Islamic financial institutions must account for risk, inflation, and operational costs. These factors ensure they can continue offering Shariah-compliant services responsibly, and sometimes lead to rate adjustments for new applicants.

❓ Isn’t Profit Rate Just Another Name for Interest?

This is one of the most common questions we hear—and it’s an important one to clarify.

While profit rates and interest rates may appear similar in that both impact what a customer pays over time, they come from entirely different principles and contractual structures.

In a conventional loan, a lender provides money directly and charges interest on the amount borrowed. The payment is for the use of money over time.

In contrast, Islamic home financing involves a real, underlying transaction—such as a property sale (Murabaha) or lease (Ijara). The profit rate reflects the agreed-upon markup or lease terms for that transaction. It is not a fee on borrowed money, but rather part of the price of the asset or service being provided.

Why do profit rates seem to follow market trends then?

Because Islamic financial institutions operate in the same economy as conventional ones, they use widely recognized market benchmarks (like SOFR) to price contracts responsibly. This helps ensure fairness, risk management, and sustainability—without ever involving interest-based lending.

📌 Bottom line: A profit rate is not simply an “interest rate by another name”—it exists within a fundamentally different framework that honors both Shariah principles and contractual transparency.

🧐 What Homebuyers Should Watch For

If you’re considering halal home financing, you don’t need to become an economist—but a little awareness goes a long way. Here’s what to monitor:

✅ Benchmark Trends

Pay attention to financial news around rates like SOFR or general announcements from the Federal Reserve. When these rise, it could indicate that profit rates on new contracts may also adjust in the near term.

✅ Fixed vs. Adjustable Rates

Ask your Islamic finance provider whether the structure you’re considering is fixed or adjustable. A fixed profit rate stays the same for the life of the contract, while adjustable models may shift over time.

✅ Market Timing

If you’re nearing the point of applying for home financing, knowing where the market is headed can help you decide when to move forward. This decision should always be made based on your financial readiness—not just rate trends.

🤝 Understanding the Bigger Picture

Shariah-compliant home financing offers an alternative approach for those seeking to align their financial choices with their values. While profit rates may respond to similar market indicators as interest rates, the underlying contracts and intent differ significantly.

The goal is to offer a path to homeownership that is ethically structured, transparent, and faith-conscious—without compromising financial prudence.

📌 Final Thoughts

As the market shifts, staying informed helps you make values-based, well-timed decisions. Whether you’re ready to buy now or planning ahead, understanding how market rates influence profit rates gives you the clarity to move forward with confidence.

At Devon Islamic, we’re here to educate and empower—not pressure. If you’re curious about Shariah-compliant financing or want to explore your options, we’re happy to help guide you through it.

Want to learn more about halal homeownership?

📲 Visit our Resources tab or connect with a Devon Islamic specialist today.