In the journey towards homeownership, understanding the fundamental elements of home financing is crucial. At Devon Islamic, we’re committed to empowering you with the knowledge and tools you need to navigate this process confidently. Let’s delve into the essential building blocks of home financing and unlock the doors to your dream home.

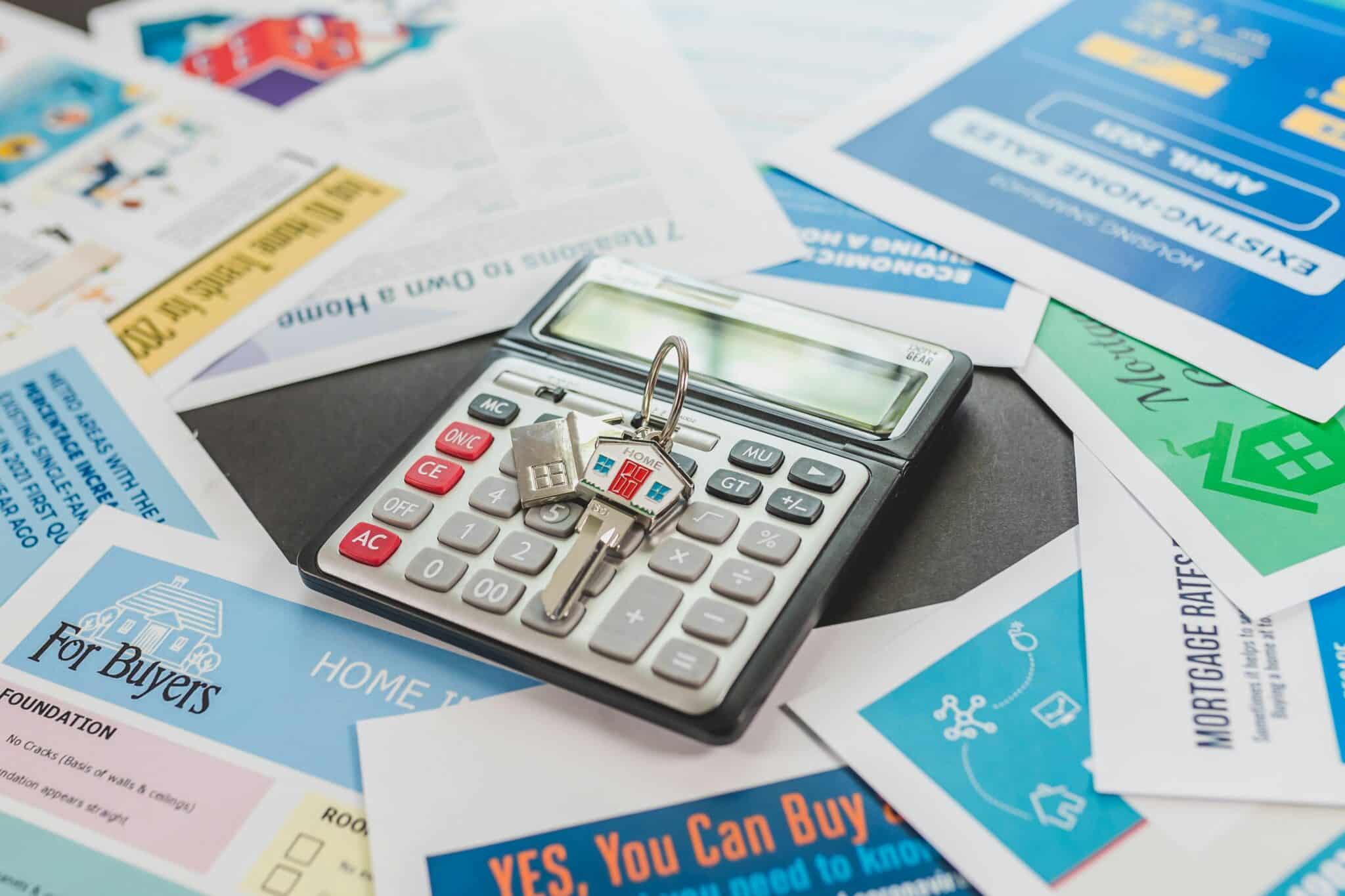

- Credit Score and History: Your credit score and history are key factors that home financiers consider when evaluating your home financing application. Maintain a strong credit profile by paying bills on time and keeping credit card balances low.

- Pre-Approval: Gain a competitive edge in the housing market by obtaining a pre-approval letter. This process involves a review of your financial information to determine the maximum amount you qualify for, giving you a clear picture of your buying power.

- Down Payment: Saving for a down payment is a critical step in the homebuying journey. While the amount required varies, having a larger down payment can lower your monthly payments and potentially qualify you for better contract terms.

- Home Financing Options: Explore different options, to find the one that best suits your needs. Our team at Devon Islamic can help you understand the pros and cons of each option.

- Profit Rates: Keep an eye on rates, as they can significantly impact the overall cost of your mortgage. Locking in a favorable rate can save you thousands of dollars over the life of your contract.

- Contract Term: Choose a contract term that aligns with your financial goals and budget. Shorter loan terms typically have higher monthly payments but result in substantial savings over time.

- Closing Costs: Be prepared for closing costs, which include fees for appraisal, title insurance, and contract origination. Understanding these costs upfront can help you budget accordingly and avoid any surprises at closing.

- Debt-to-Income Ratio: Home Financiers evaluate your debt-to-income ratio to assess your ability to manage monthly payments alongside other debts. Aim for a low DTI to improve your chances of approval.

- Escrow Accounts: Establishing an escrow account can streamline the management of property taxes, homeowners’ insurance, and other expenses. Our team can guide you through this process and ensure smooth closing.

- Financial Planning and Budgeting: Take a proactive approach to financial planning and budgeting to ensure a successful homebuying experience. Consider factors such as future expenses and long-term financial goals when crafting your budget.

By mastering these building blocks of home financing, you’ll be well-equipped to make informed decisions and achieve your homeownership goals. We’re here to support you every step of the way on your journey towards owning a home that reflects your values and aspirations. Reach out to our team today to learn more about our Sharia-compliant financing options and start your path to homeownership with confidence.