For many first-time homebuyers, the biggest obstacle to homeownership isn’t finding the perfect house—it’s saving for the down payment. But what if we told you that help is available… and you may qualify?

At Devon Islamic, we’re proud to offer a $10,000 Down Payment Assistance Program (DPP) to make halal homeownership more accessible for families across the country.

Here’s everything you need to know about how it works—and why it could be the key to opening the door to your next chapter.

🏠 What Is Down Payment Assistance?

Down Payment Assistance (DPA) is a financial resource designed to help eligible buyers cover some or all of the upfront costs of buying a home—particularly the down payment and sometimes even closing costs.

The goal? To help responsible buyers who are ready to own but may not have large cash reserves saved up.

Devon Islamic’s DPP program is fully compatible with halal Murabaha financing and is a powerful tool for first-time buyers seeking a Shariah-compliant path to ownership.

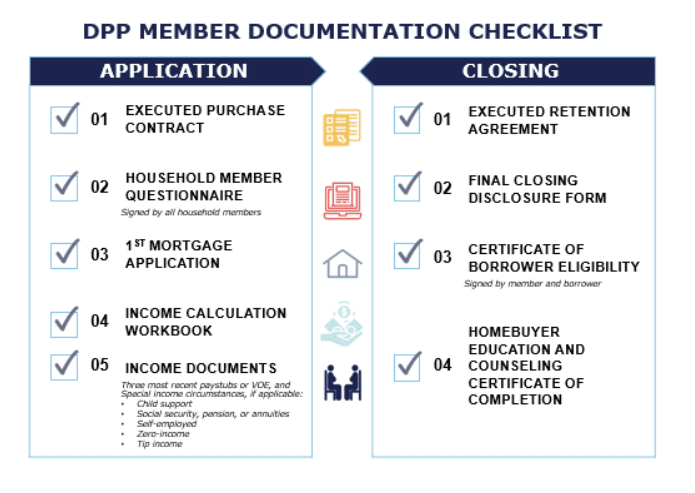

✅ Who Is Eligible?

You may qualify for Devon Islamic’s $10,000 DPP program if:

- You are a first-time homebuyer (or haven’t owned a home in the last 3 years)

- Your income and property meet the eligibility guidelines

- You complete a homebuyer education course (usually online and often free)

- You apply through one of our certified lenders and complete your financing through Devon Islamic

💡 Even if you’re not sure you qualify, it’s worth asking—many people are surprised to find they do!

💼 How Does It Work?

- The funds can be applied toward your down payment or closing costs.

- In many cases, you don’t have to repay the money—as long as you meet the program requirements and stay in the home for a designated time period (often 5 years).

- It’s structured to work seamlessly with halal financing—no riba, no compromise.

🌟 Why This Matters—Especially for Halal Homebuyers

In many Muslim households, saving for a down payment can be especially challenging due to:

- Larger family sizes or single-income homes

- Avoidance of interest-bearing savings accounts

- Financial priorities like zakat, hajj savings, or student loan payments

This program bridges that gap, empowering more families to own homes in a way that honors their faith. You don’t have to delay your dreams because of a down payment.

📊 How to Apply

- Speak to a Devon Islamic Finance Specialist

They’ll assess your financial profile and help determine if you meet the DPP criteria. - Complete the Homebuyer Education Course

This quick step ensures you’re fully informed and financially prepared. - Get Prequalified & Begin Your Application

Once qualified, we’ll help you find a halal-friendly home and complete the Murabaha financing process.

🔑 Real Impact, Real Stories

Many families have used the $10,000 DPP to:

- Purchase their first home earlier than expected

- Avoid dipping into emergency or savings funds

- Transition from renting to ownership without financial strain

It’s not just about dollars—it’s about opening the door to what’s next with barakah and financial confidence.

📞 Ready to See If You Qualify?

Let us help you take the first step toward halal homeownership—without worrying about the down payment.

💬 [Book a Call With a Specialist]

📄 [Start Your Halal Prequalification]

Equal Housing Lender. NMLS #412368. This is not a loan commitment or guarantee of any kind. Terms and conditions apply. Subject to borrower and property qualifications. Not all applicants will qualify. Rates and terms are subject to change without notice. Some products and services may not be available in all states.